Saving on costs

SADAD strives for convergence with as many technology frameworks as possible in order to broaden your user base.

You can accept online payments through all available ways, such as credit cards, NAPS debit cards, and wallets, by

conveniently incorporating SADAD Payment Portal into your current setup.

Single API

integration for

all payment methods

Save time

and effort thus

lowering the probability

of mistakes

Go live in

less than 2 hrs

The Card Storage Vault from SADAD is planned to safely store and recall your customers' credit card information for quicker repeat purchases. The card information of the customer is secured and safely stored against a special token/identifier sent by you when the transaction is initiated. One of these standards, tokenization, removes card data entirely, adding another level of security. it solves the problem of storing real credit card data and helps to secure the payment process on your website or mobile application.

Saving on costs

Enhanced security

Allow customers to pay with a single click

Merchants may ensure that their clients pay for the goods and services they use by pre-authorizing payments. A pre-authorization is a temporary lock imposed on a customer's credit card by a merchant in order to reserve funds for a potential purchase transaction.

More successful payments mean more sales for your business.

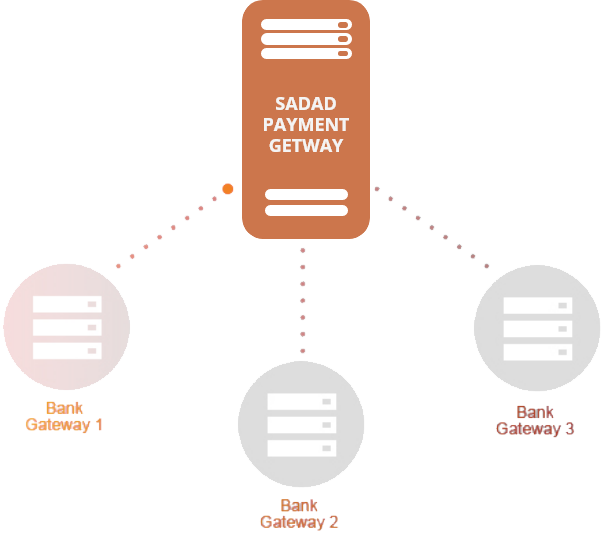

Conversions are effective as transfers are automatically routed to the active server

Increases successful conversions by using cutting-edge technologies and advanced logic

SADAD uses intelligent routing technology using direct Acquiring banks’ gateway integration to manage the transaction flow and improve performance.

Our system detects the downtime and automatically route transactions to another bank’s server to provide seamless transaction experience to payers.

Retry your payments without returning to the merchant's website & increases the success rate by more than 10%.

If a customer's payment fails due to reasons such as wrong credit card numbers, bank outages, and so on. With our smart retry payment system, you can give your customer more chances to complete the purchase instead of going through the whole process of filling out the payment details.

Most of the time, transfers malfunction when network servers are down, and our servers continue to listen and pull the transaction as soon as the network is restored.

Sadad's Webhooks alerts functionality brings you up to date if such payment-related incident happens in your account.

You can customize these webhooks from your Dashboard, with different URLs for live and test modes. Notifications will be sent to the URL by Sadad.

Customers have a more frictionless journey across the merchant's website owing to

Sadad's world-class security measures. As a result, the 3DS protocol's drop-off rate will be drastically reduced,

and customers will gladly return to the merchant's website.

SADAD is PCI DSS Level 1 compliant and offers strong support. Adding 3D Protected 2.0 to your checkout process will help guarantee a secure checkout for your customers, protect your company against unauthorized transactions, and ensure that your transactions comply with SCA requirements.

Sadad's rich data authentication system allows issuers to perform Risk-Based Authentication

An additional layer of authentication ensures that you will only accept card payments from legitimate customers.

If a transaction is disputed or charged back due to fraud, the responsibility for the transaction shifts from the merchant to the card issuer.

To stop illegal practices, our experienced fraud identification team closely monitors each transaction.

When you have to handle large amounts of transactions in your business, SADAD's Fraud & Risk Detection System is extremely important. It enables you to detect fraudulent activity before it progresses any farther in the payment chain. Our algorithms have an exceptional degree of risk analysis by comparing each transaction to a negative database compiled over a decade and tested through various parameters such as high-risk global IP address authentication, BIN number mapping & velocity checks.

With SADAD's multilingual checkout page deliver a “localized” shopping

and payment experience to all segments of your target audience.

Supported Language in Qatar

You can now target consumers by ads in their native language,

and you can see eye-opening returns with better purchase success rates.

Accept payments in major foreign currencies and allow your customers to pay in the currency they are most familiar with.